Your question:

Do nonprofit organizations still need to file tax returns even if they don’t pay taxes? Don’t they file to keep their nonprofit organization status?

Linda says:

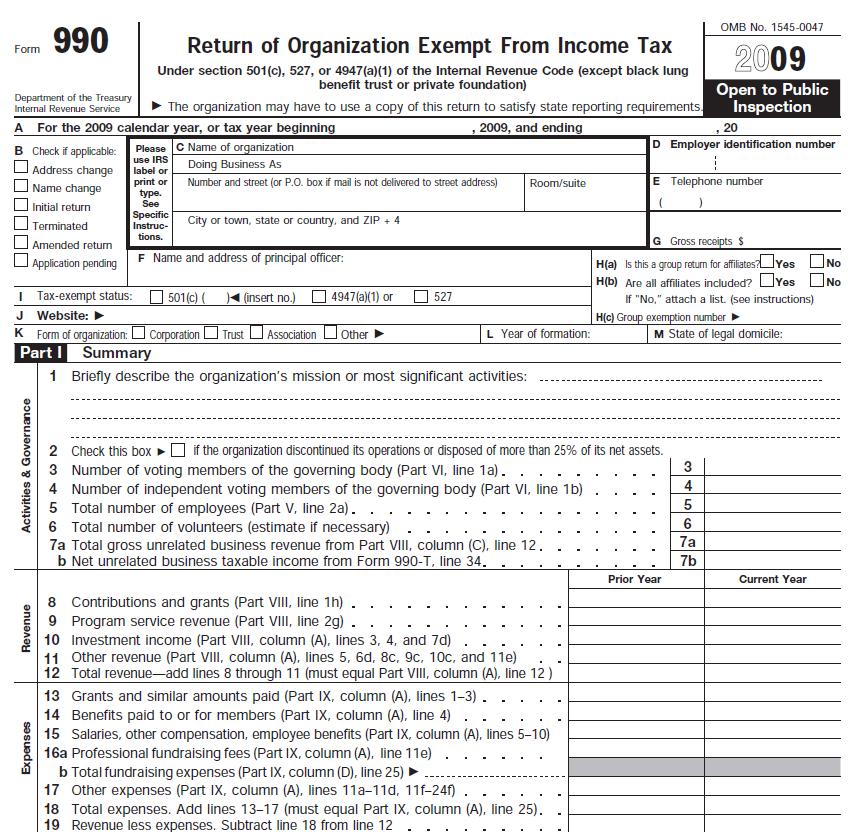

The form you are looking for is Form 990 Return of Organization Exempt from Income Tax. I have inserted Page One below.

You need to know who must file, how to cashflow the form and what else to ask.

Who must file?

Primarily any organization (other than churches and govt entities) with more than $25,000 gross receipts must file the 990. Here is the list from the IRS:

Generally, tax-exempt organizations must file an annual information return. Tax-exempt organizations that have annual gross receipts not normally in excess of $25,000 are not required to file the annual information return, but may be required to file an annual electronic notice (e-Postcard) Form 990-N.

In addition, churches and certain religious organizations, certain state and local instrumentalities, and other organizations are excepted from the annual return filing requirement.

Form 990

Here is the form. Click on it to make it bigger:

Basic Cashflow

(Lines 8 through 19 plus supporting schedules):

- Line 19 Revenue Minus Expenses (The non-profit equivalent of Net Profit)

- Add back Part IX, Line 20 Interest

- Enter Debt on your debt list or subtract, depending on your guidelines. (See note below)

- Add back Part IX, Line 22, Column (A): Depreciation, Depletion and Amortization

- Look for other major nonrecurring items to add back

Review the 990

- To understand the charitable activity in which they are engaged.

- To consider if Insurance on Part IX, Line 23 is adequate.

- To review their Balance Sheet on Part X for significant changes.

Debt

Unlike the 1120, 1065 and 1120S, the Balance Sheet on a Form 990 does not break the debt into current and long-term. Thus, the shortcut I include in my manual on comprehensive self-study manuals won’t work. You’ll need debt information from the non-profit to determine cashflow available to pay debt.

Non Profit Status

For those organizations not required to file, they maintain their non-profit status by the way they file with the Secretary of State (or your state’s entity that licenses corporations) which is required on a yearly basis.

Non-profit organizations are allowed to have up to a certain amount of unrelated business income. This does not negatively impact their non-profit status. Examples:

- A professional association may rent it’s membership list.

- A university might rent it’s football field to a professional team for training.

The Bottom Line

- Cashflow a 990 similar to how you would cashflow an 1120.

- Scan the rest of the document to understand the purpose of the organization.

- Compare the beginning and ending balance sheet for major changes.

As I write this, we are starting to recover from the worst recession in memory. Nonprofit organizations have been hit as hard as businesses, and in many cases harder. Be sure you understand their current situation and their short-term plans.